Content

The secretary was responsible for responding and you will after the up on all questions today and you will casual after. Your own fulfillment try our very own concern plus research away from your/her will determine their job score. Customer get shell out ½ of put prior to solution initiation as well as the harmony on the first statement. Do not were Societal Security amounts otherwise one individual or confidential information. It Google™ interpretation function, considering for the Business Taxation Board (FTB) website, is for general suggestions merely.

Excite find a duplicate of one’s plan for an entire conditions, criteria and exclusions. Visibility scenarios is actually hypothetical and you can found to own illustrative motives only. Coverage is founded on the real things and you may issues offering increase to help have a glimpse at this site you a declare. Pay a tiny monthly fee as little as $5 rather than a big upfront security put. Problems usually go prior to a legal (there aren’t any juries) within a month or a couple. Residents could possibly get sue for the shelter deposit amount which they faith the master wrongfully withheld, as much as the state’s limit.

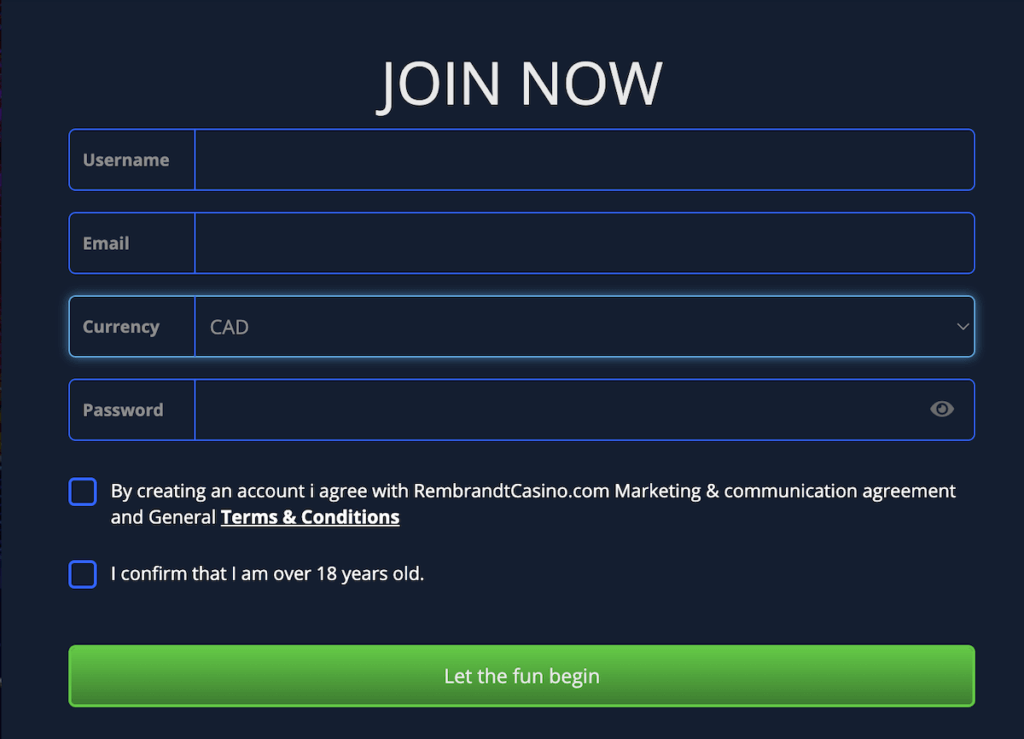

Personal Protection Pros – have a glimpse at this site

Certain $5 deposit gambling enterprises make it professionals in order to allege incentives all the way to $20. Bonuses such as this will let you gamble above you can have with only a $5 put. The level of the put shouldn’t affect the result of the online game. However, it does probably take you more gains so you can cash out an adequate amount during the a great $5 minimal deposit gambling enterprise. Although not, you can come across certain games in certain 1 dollars put gambling enterprises that have the absolute minimum choice that is greater than the new $5 your deposited. It usually is advisable that you take a look at for each and every video game’s standards and you will constraints ahead of time, you wear’t affect invest your $5 put on the a-game you simply can’t gamble.

Mount a copy away from government Form 1066 on the right back of the fresh completed Setting 541. A house Withholding Report – Productive January step one, 2020, the actual estate withholding variations and you will tips have been consolidated on the you to definitely the brand new Setting 593, A home Withholding Report. The credit try 50% of your own number provided because of the taxpayer to the taxable 12 months for the College Access Tax Borrowing Financing. The degree of the financing is designated and you will certified because of the CEFA. To learn more check out the CEFA webpages at the treasurer.ca.gov and appear to own catc.

Withholding on the Suggestion Earnings

Your own loyal membership movie director and your Panama attorney usually supplement and you will guide you by this process.If you want to make use of your organization, we will manage the procedure to you. Do not is withholding out of Variations 592-B or 593 otherwise nonconsenting nonresident (NCNR) member’s tax away from Schedule K-step 1 (568), Member’s Show of money, Write-offs, Credits, an such like., line 15e on this range. IRC Part 469 (and therefore California includes because of the reference) basically restrictions deductions from passive points for the number of earnings derived from all of the passive things. Similarly, credits of inactive issues try limited by income tax owing to including things. This type of restrictions is actually first used at the property or faith level. Obtain the recommendations for federal Form 8582, Passive Activity Losings Constraints, and you can federal Form 8582-CR, Couch potato Hobby Credit Restrictions, more resources for passive items loss and you can credit limitation legislation.

Our $5 minimal put web based casinos read repeated audits to possess video game equity and you may user defense. One of several recognized licenses one secure our believe are those away from the united kingdom Gaming Fee, the newest MGA, plus the iGaming Ontario otherwise AGCO licenses. We recommend seeking out that it give, specifically if you like to play slot game.

Extra Benefits of using Baselane

A houses perimeter work for boasts money to you personally or on your part (as well as your family members’ if your family members life along with you) just for the following. All of the wages and every other compensation to own services performed regarding the United states are considered to be from supply regarding the United States. Really the only exclusions to this laws is discussed below Team out of international people, communities, otherwise practices, later, and you may under Crew participants, before. Quite often, dividend earnings obtained out of home-based businesses is actually U.S. supply money. Dividend earnings away from foreign firms is often overseas origin money.

Moneylines

These earnings can be excused from U.S. income tax or may be susceptible to less speed out of income tax. To determine tax for the nontreaty income, figure the newest tax in the either the brand new apartment 31% rate or the graduated rate, based upon if the income try efficiently linked to your own trade or organization in the united states. A nonresident alien will be have fun with Setting 1040-Es (NR) to find and you may spend estimated tax. For individuals who shell out from the consider, enable it to be payable in order to “United states Treasury.” If you think your self-a career income is subject in order to U.S. self-employment taxation which is exempt away from international public defense taxes, consult a certification of Visibility from the SSA. That it certification will establish your own exclusion out of international personal defense fees.

Everything within this book isn’t as total for resident aliens as it is to own nonresident aliens. Citizen aliens are often managed just like U.S. people and will discover more information in other Irs courses from the Irs.gov/Models. When you generate a deposit, you can get 80 free revolves because the an advantage.

The brand new faith instrument provides you to funding progress are placed into corpus. 50% of your own fiduciary charge are spent on earnings and you may fifty% to help you corpus. The brand new faith obtain $step one,500 of miscellaneous itemized write-offs (chargeable to income), that are subject to the two% floor. The brand new trustee produced a good discretionary shipment of your bookkeeping income of $17,five-hundred on the faith’s sole beneficiary. Allowable management costs are the individuals costs which were sustained within the relationship on the administration of your own estate otherwise trust who does perhaps not had been incurred if your property were not held such estate otherwise believe. Faith costs based on additional funding guidance and you will funding management charges is various itemized write-offs subject to the two% floor.

Fits incentives or put suits bonuses have a tendency to match your $5 deposit casino greatest-to a particular the amount, generally at the fifty% otherwise one hundred%, even though most other rates could possibly get pertain. When you’re these types of also provides are common, it don’t constantly extend because the much having shorter deposits, so you might perhaps not see the same increase like with larger top-ups. Ruby Chance try an excellent $5 deposit local casino one to promises the newest welcome bonus out of C$250. I encourage which casino because it also provides more step 1,000 games and you may a mobile software. Dependent inside the 2003, it is one of the best $5 deposit gambling enterprises inside Canada. Sign up with All Slots Gambling establishment and open a c$step 1,five hundred in the extra finance bequeath round the very first about three places, and 10 totally free spins daily and you will a shot in the profitable up to C$1,100,000.